massachusetts restaurant alcohol tax

This page discusses various sales tax exemptions in Massachusetts. Meals are also assessed at 625 but watch out.

6 Ways To Lose Your Liquor License

Otherwise our state and federal reporting will not agree putting us at risk of a federal tax audit for trying to help our communities.

. Generally any Chapter 180 corporation association or organization must pay a yearly excise tax of 57 on the gross receipts from the sale of alcoholic beverages. Not included in the bill. The words sales tax compliance can put even the most seasoned restaurant owner on edge and for good reason.

Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon. Majestic Life Church Service Times. The Boston Massachusetts sales tax is 625 the same as the Massachusetts state sales tax.

A 625 state meals tax is applied to restaurant and take-out meals. Be sure to check if your location is subject to the local tax. The measure asked voters whether to repeal a sales tax on alcohol sales.

In MA transactions subject to sales tax are assessed at a rate of 625. A Massachusetts Alcohol Tax can only be obtained through an authorized government agency. The Massachusetts excise tax on liquor is 405 per gallon lower then 68 of the other 50 states.

Therefore the total excise tax on spirits is 2630 per gallon. Councilors Bill Linehan and Frank Baker argued in favor of imposing a 2 percent tax on alcohol sold in Bostons restaurants and liquor stores. Income Tax Rate.

Norton State House News Service April 3. Restaurants In Matthews Nc That Deliver. Among several other non-restaurant-related matters that remains up for further.

Baker Signs Bill Allowing Some Massachusetts Restaurants To Sell Beer And Wine With Takeout Delivery By Michael P. Massachusetts excise tax on Spirits is ranked 34 out of the 50 states. The Massachusetts tax on meals sold by restaurants is 625 this is true for all cities and counties in MA including Boston.

625 of the sales price of the meal. Opry Mills Breakfast Restaurants. The ballot measure for the 2010 ballot was added after the Massachusetts State Legislature increased the sales tax in the state from 5 to 625 and eliminated an exemption.

The tax is 625 of the sales price of the meal. While many other states allow counties and other localities to collect a local option sales tax Massachusetts does not permit local sales taxes to be collected. Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7.

However alcohol excise taxes recently went up about 150. Are Dental Implants Tax Deductible In Ireland. This includes fraternal organizations.

This must be collected from the purchaser and separately stated and charged on the bill. Massachusetts Restaurant Association President. Restaurants In Erie County Lawsuit.

It would mean a tax on a tax We just cant turn to an increase in taxes whenever theres a problem said Bob Luz President and Chief Executive Officer of the Massachusetts Restaurant Association. Massachusetts Restaurant Alcohol Tax. This is because spirits have higher alcohol content than the other categories.

While the Massachusetts sales tax of 625 applies to most transactions there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Massachusetts. The Boston Sales Tax is collected by the merchant on all qualifying sales made within Boston.

What transactions are subject to sales tax. A local option meals tax of 075 may be applied. Kay Khan a Newton Democrat is.

Alcohol is already taxed. A 625 state sales tax is applied to all alcoholic beverages sold at retail. Alcohol and sugary drinks in Massachusetts could carry a heavier price tag if two proposed bills are passed.

The continuation of a fee cap on third-party delivery companies. Massachusetts state taxes on hard alcohol vary based on alcohol content place of production size of container and place purchased. Before August 1 2009 the tax rate was 5.

The state of Alaska adds an excise tax of 1280 per gallon of spirits. Massachusetts Liquor Tax 34th highest liquor tax. In addition to the extension of to-go alcohol in Massachusetts provisions that made it easier for restaurants to add outdoor dining areas will continue until April 21 2022.

The No Sales Tax for Alcohol Question also known as Question 1 was on the November 2 2010 ballot in Massachusetts. Hotel rooms state tax rate is 57 845 in Boston Cambridge Worcester Chicopee Springfield and West Springfield. Under 15 110gallon over 50 405proof gallon 057 on private club sales.

Massachusetts general sales tax of 625 does not apply to the purchase of liquor. In Massachusetts liquor vendors are responsible for paying a state excise tax of 405 per gallon plus Federal excise taxes for all liquor sold. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Massachusetts Alcohol Tax.

Find out more about the citys taxes on Chicagos government tax list. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. It also adds an excise tax of 107 to beer and 250 to wine.

Alaskans are free of sales taxes. Sales tax and everything that goes along with it is a time-consuming pain in the you-know-what to manage especially for busy restaurant owners. - Massachusetts excise tax relief for alcohol used in the formulation of hand sanitizer which we can report through the existing AB-1 form so that our Federal and Massachusetts reports remain consistent.

The Difference Between A Bar And A Lounge Lie In The Business S Style And Entertainment Choices Individuals Should Choose Fr In 2021 Business Fashion Entertaining Bar

States Relax Alcohol Rules During Covid 19 Pandemic Multistate

Cheaper Liquor Licenses Not So Fast Restaurateurs Say The Boston Globe

The Inn The Beach Plum Beach Plum Beach Marthas Vineyard

How To Stop Companies From Marketing Sugary Drinks To Kids Kids Meals Sugary Drinks Healthy Kids

State Guide For Acquiring Liquor Licenses Pourmybeer

Liquor Pricing How To Price Drinks At Your Bar 2ndkitchen

Get Rewarded At Lunch Buy 5 Lunches At El Mariachi At Wareham And Your 6th Is On Us Pick Up A Rew Loyalty Rewards Program Rewards Program Loyalty Card

Function Agreement Restaurant 45 Agreement Function Function Room

Sin Taxes Taxing Our Vices Infographic Infographic Map Infographic Illustration

Is Dry January Hurting Bars And Alcohol Retailers Business Execs Chime In Fox Business

Why Charge Corkage And What S Too Much

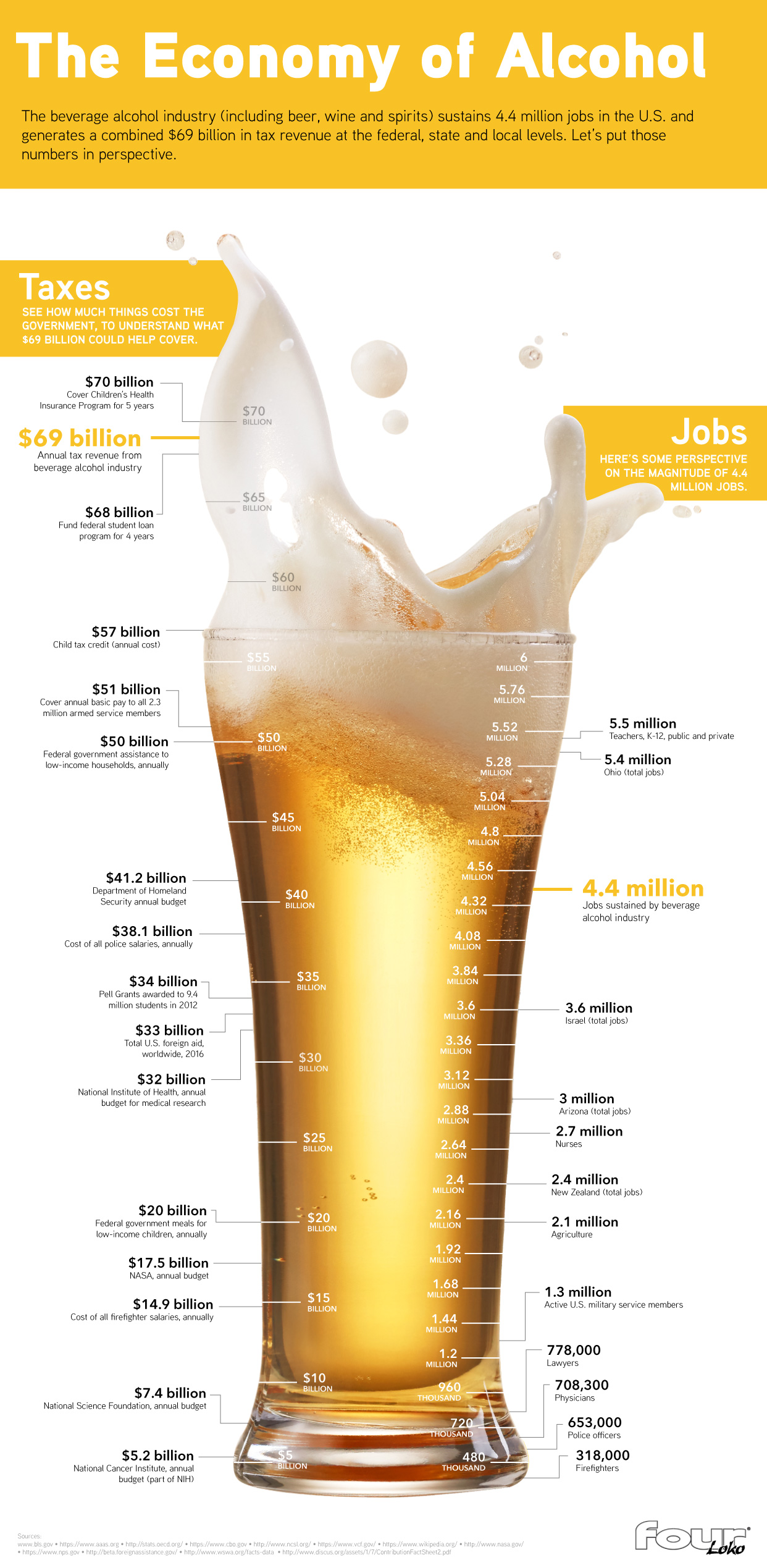

The Alcohol Beverage Industry An Economic Engine

Task Force Wants Relaxed Alcohol Laws Higher Taxes The Boston Globe Harvard Square Harvard Franklin

Georgia S Mimosa Mandate Is A Victory For Alcohol Freedom

How To Get A Liquor License In All 50 States Cost 2ndkitchen

How To Get A Liquor License In 2022 Restaurant Clicks

Liquor Cost 2022 Beverage Cost Percentage Formula Sheet

How To Sell Alcohol Online Delivery Laws In All 50 States 2ndkitchen